does texas have state inheritance tax

There is a 40 percent federal tax however on estates over 534. In 2022 estates with a value of 12060000 must file a return a significantly increased upper bound compared to the 1500000 seen in 2004 and 2005.

How Do State Estate And Inheritance Taxes Work Tax Policy Center

There is no inheritance tax in Texas.

. 4 the federal government does not impose an inheritance tax. The state sales tax rate in Texas is 625 percent. Texas does not have an inheritance tax meaning no death-related taxes are ever owed to the state of Texas.

Inheritance Tax In Texas. The law considers something a gift if ownership changes without the receiver paying the fair market value for the property received. There are no inheritance or estate taxes in Texas.

While there is no state inheritance tax in Texas your estate may be subject to the federal estate tax. There is a 40 percent federal tax however on estates over 534. 4 the federal government does not impose an inheritance.

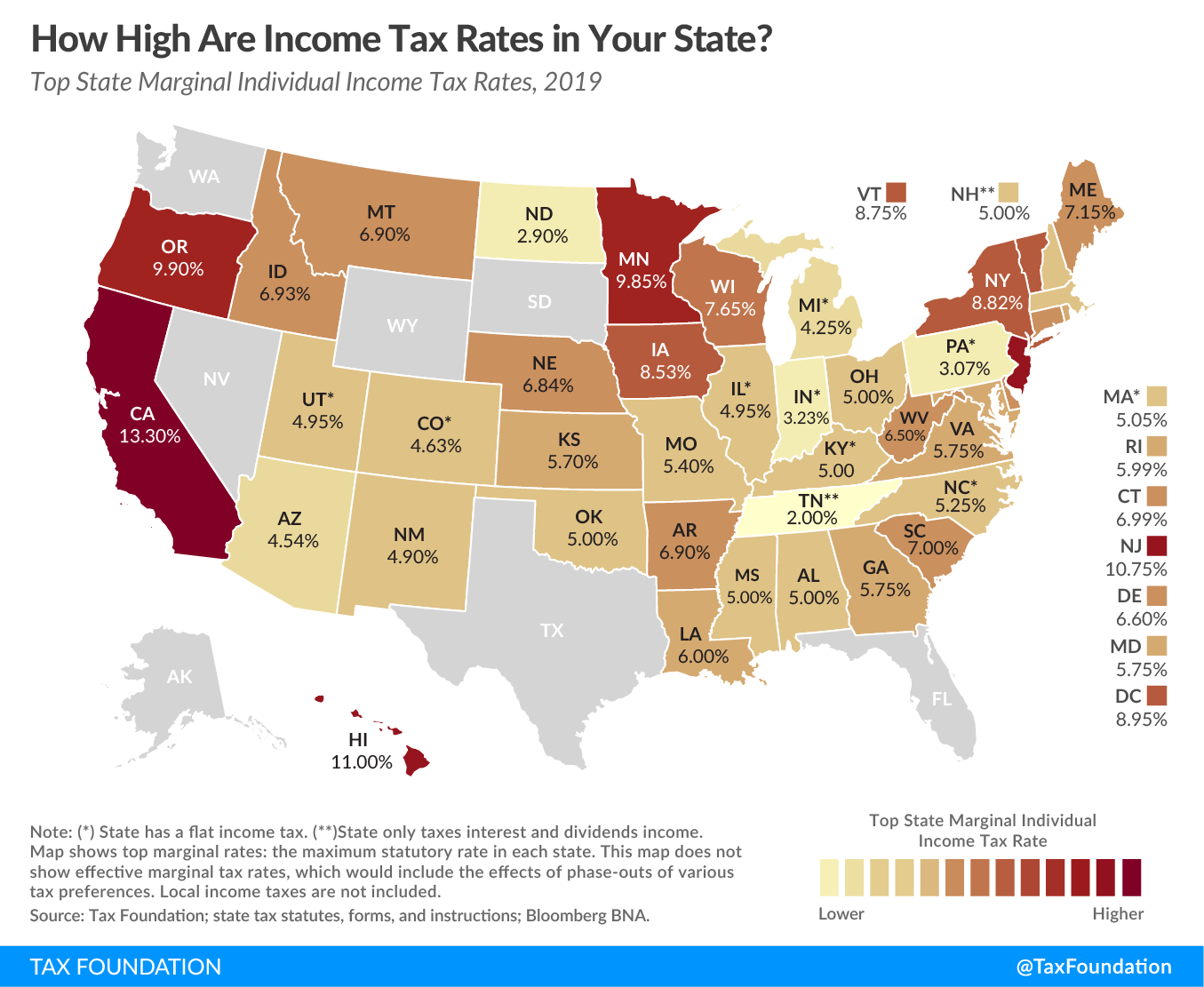

The state repealed the inheritance tax beginning on Sept. Twelve states and the District of Columbia impose estate taxes and six impose inheritance taxes. Maryland is the only state to impose both now that New Jersey has repealed.

The federal estate tax is a tax on your right to transfer property at your. The big question is if there are estate taxes or inheritance taxes in the state of Texas. On the one hand Texas does not have an inheritance tax.

The short answer is no. There is a 40 percent federal tax however on estates over 534. Death Taxes in Texas.

Texas does not have an inheritance tax meaning no death-related taxes are ever owed to the state of Texas. Texas does not have an inheritance tax meaning no death-related taxes are ever owed to the state of Texas. Inheritance and estate taxes are often grouped under the label death taxes Texas repealed its inheritance tax on September 15 2015.

Maryland is the only state to impose both. However if a loved one who lives in another state leaves you money you may be subject to inheritance taxes in. There is a 40 percent federal tax however on estates over 534.

However other states inheritance taxes may apply to you if a loved one who lives in those states gives you money so make sure to. Before breathing too big a sigh of relief Texan beneficiaries need to be aware that although Texas has no inheritance tax assets may still be subject to state. Hawaii and Washington State have the highest estate tax top rates in the nation at 20 percent.

Once again Texas has no inheritance tax. Gift Taxes In Texas. Youre in luck if you live in texas because the state does not have an inheritance tax nor does the federal government.

There are not any estate or inheritance taxes in the state of. Maryland imposes the lowest top rate at 10 percent. However a Texan resident who inherits a property from a state that does have such tax will still be responsible for paying.

Eight states and the District of Columbia are next with a top rate of 16 percent. Final federal and state income tax returns. Of the six states with inheritance taxes Kentucky and New Jersey have the highest top rates at 16 percent.

The Texas estate tax system is a pick-up tax which means that TX picks up the credit for state death taxes on the federal. The good news is that texas doesnt impose an. Youre in luck if you live in texas because the state does not have an inheritance tax nor does the federal government.

Texas does not have an inheritance tax meaning no death-related taxes are ever owed to the state of Texas. Does Texas Have an Inheritance Tax or Estate Tax. There is also no inheritance tax in Texas.

However in Texas there is. This means that the Texas Constitution also limits the Texas Legislature from imposing an inheritance or estate tax on real and personal.

Estate Planning Law Office Of Nancy Hui

Estate Personal Property Inventory Form Unique Texas Inheritance Tax Forms 17 100 Small Estate Return Inheritance Tax Personal Property Job Letter

Texas Attorney General Opinion Ww 922 The Portal To Texas History

Is There An Inheritance Tax In Texas

Blog Pakis Giotes Page Burleson A Professional Corporation

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

/cloudfront-us-east-1.images.arcpublishing.com/dmn/XON2HRNKLFDBLM6ZDNGOYDTUVQ.png)

Death And Taxes The Imperiled Federal Estate Tax Exemption

State By State Estate And Inheritance Tax Rates Everplans

Estate Inheritance Taxes In Texas Vs California

Texas Estate Tax Planning Boerne Estate Planning Law Firm

Texas Estate Tax Everything You Need To Know Smartasset

Us State Tax Planning Gfm Asset Management

State Estate And Inheritance Taxes

Capital Gains On Inherited Property In Texas You Need To Know Now Michael Ryan Money

Mckinney Estate Tax Planning Attorney Luce Evans Law

Don T Forget To Take State Estate Taxes Into Account

Is There An Inheritance Tax In Texas